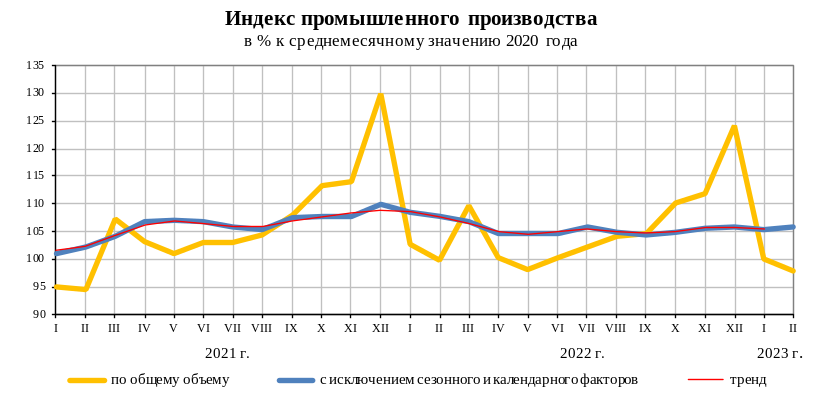

Dynamics of industrial production in February 2023

The volume of industrial production in February 2023 decreased by (-)1.7% compared to the same period in 2022. Compared to January 2023, the decrease was (-)2.1%. In the first two months of 2023, the industrial production index decreased by (-)2.0% compared to January-February 2022.

When calculating the industrial production index, Rosstat takes into account the dynamics of output and services in the commodities sector, manufacturing, thermal and electric power, as well as in water supply and sanitation, waste management and activity on liquidation of pollution.

The dynamics of industrial production in February was affected by:

- calendar factor: the number of working days in February 2023 is less than in February 2022 – 18 working days vs 19. Compared to January 2023, there was 1 more working day in February – 17 in January and 18 in February;

- temperature factor: in February 2023, the average temperature in most of Russia exceeded the norm by 2-8 °. It was noticeably colder than normal only in the east of Yakutia and in most of the Far East (anomalies reached 4 degrees Celsius). On the European territory of the country, the average temperature was above the month average.

Compared to February 2022, mining decreased by (-)3.2%, manufacturing decreased output by

(-)1.2%, industries related to water supply and sanitation, waste management and activity on liquidation of pollution – by (-)9.4%. The energy sector showed positive dynamics – (+)2.7%.

In the raw materials sector, coal production volumes decreased by (-)4.7% compared to February 2022, oil and gas – by (-)1.8%, metal ores – by (-)4.6%, other minerals, including stone, crushed stone and sand – by (-)20.6%.

In manufacturing, the increase in output by February 2022 was shown by industries related to the production of finished metal products (except machinery and equipment) – by (+)38.8%, the production of computers and peripherals, optical and electronic products – by (+)19.3%, other vehicles (including aviation equipment, shipbuilding and etc.) – by (+)10.3%, food – by (+)4.2%.

However, the output of motor vehicles, trailers and semi–trailers decreased by (-)49.8%, medicines and materials used for medical purposes – by (-)22.0%, the production of other finished products – by (-)14.3%, wood and wood products – by (-)17.7%, paper and paper products – by (-)8.8%, machinery and equipment not included in other groupings (including machine tool construction, production of metallurgical, mining equipment, agricultural machinery, etc.) - by (-)13.0%, tobacco products – by (-)9.2%, chemicals and products chem. industry – by (-)6.6%, other non–metallic mineral products (building materials, etc.) - by (-)6.3%.

Electricity generation increased by (+)1.6% compared to February 2022, steam and hot water generation - by (+)5.2%.

Compared to January 2023, the industrial production index in February 2023 was 97.9% (a decrease of (-)2.1%).

The decrease in dynamics in February compared to January is regularly recorded by Rosstat and is the end of the traditional seasonal trend (reduction in production volumes in January and February compared to previous periods).

Industries that showed growth in February 2023 compared to February 2022:

- production of finished metal products (except machinery and equipment) – (+)38.8%;

- production of computers, electronic and optical products – (+)19.3%;

- production of other vehicles (including aviation equipment, shipbuilding, etc.) – (+)10.3%;

- manufacture of leather and leather products – (+)5.5%;

- food production – (+)4.2%;

- metallurgical production – (+)1.1%.

Industries that reduced production in February 2023 compared to the same period in 2022:

- production of motor vehicles, trailers and semi–trailers - (-)49.8%;

- production of medicines and materials used for medical purposes – (-)22.0%;

- extraction of other minerals, including stone, crushed stone and sand – (-)20.6%;

- wood processing and production of wood and cork products – (-)17.7%, paper production – (-)8.8%;

- production of other finished products – (-)14.3%;

- production of machinery and equipment not included in other groupings (including machine tool construction, production of metallurgical, mining equipment, agricultural machinery, etc.) – (-)13.0%;

- tobacco production – (-)9.2%;

- production of chemicals and chemical products – (-)6,6%;

- production of other non–metallic mineral products (including building materials) - (-)6.3%;

- coal mining – (-)4.7%;

- furniture production – (-)4,6%;

- extraction of metal ores – (-)4,6%;

- production of textiles – (-)4.0% and clothing – (-)1.6%;

- repair of machinery and equipment – (-)2.7%;

- production of rubber and plastic products – (-)2.6%;

- oil and gas production – (-)1.8%.

Despite the decline in industrial production in February 2023 compared to the same period in 2022, managers of enterprises in mining sector and industries related to manufacturing industries demonstrate an increase in the business confidence index (see the Rosstat study "Business activity of organizations in February 2023").

The business confidence index returned to the zone of positive values in January and again showed positive dynamics in February. In the extractive industries, the growth was 1.7 percentage points – from (+)1.0% in January 2023 to (+)2.7% in February 2023. In manufacturing industries – 0.6 percentage points (from (+)2.7% in January 2023 to (+)3.3% in February 2023).

The number of optimists who assess the current demand for the products of their enterprises and the prospects for demand growth in the three-month perspective continued to grow. In mining sector, the number of optimists expecting production growth over the next three months exceeded the number of pessimists by 15 percentage points (the share of respondents expecting an increase in output – 20% and expecting a decrease – 5%).

In manufacturing industries in February, the share of optimists exceeded the share of pessimists by 30 percentage points (the share of respondents expecting an increase in output over a three–month horizon is 35% and expecting a decrease is 5%).

Improvement of the situation at their enterprises in the next 6 months is expected by 20% of the surveyed managers in the raw materials sector and 29% in the manufacturing industries. The number of optimists exceeded the number of pessimists by 14 percentage points in the mining industries and by 24 percentage points in the manufacturing industries.

Nevertheless, more than half of the managers take a neutral position, demonstrating a restrained attitude to the current state of their businesses and to the potential growth opportunities of demand and production.